Updated November 21, 2024

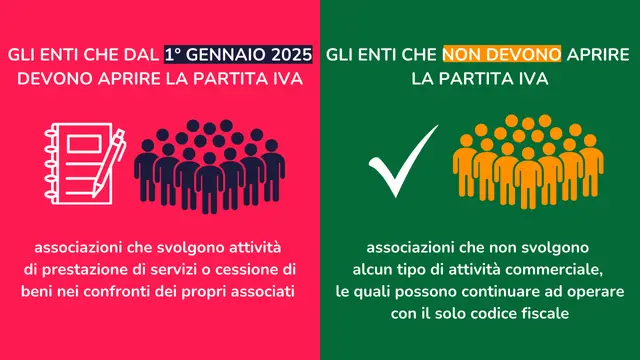

From 1 January 2025, it will be mandatory for associations that carry out sales of products and services to open a VAT number, keep accounting records and file a tax return.

This obligation arises from the fact that many associations carry out sales activities of products and services to members and non-members. These transactions, or transfers of products or services in exchange for a fee, will now have to pass under VAT management.

Without any complaints, I who have managed cultural volunteer activities with almost zero budget for more than twenty years, will get out of this situation by closing my association. But let's move on and see what changes from January 1, 2025 for associations.

I found this illustration of the very helpful third sector construction site which clarifies which associations must open a VAT number

Table of Contents

VAT Number Obligation for the Third Sector in Italy from 1 January 2025: What Changes for Associations?

From 1 January 2025, a new regulation comes into force that introduces the obligation of VAT number for many Third Sector associations in Italy. This significant regulatory change aims to standardize the tax treatment of associations and ensure greater transparency in their economic activities.

Which Associations are affected by this innovation?

In general, the VAT number requirement concerns associations that carry out economic activities, even if connected to their institutional purposes. The following associations are therefore required to open a VAT number:

- Policies

- Trade unions

- By category

- Religious

- Assistance

- Cultural

- Of social promotion

- Of extracurricular training

- Amateur sports

What are the obligations for associations with VAT numbers?

Opening a VAT number entails a series of obligations for associations, including:

- Issuing invoices: For each transfer of goods or provision of services carried out, the association must issue an invoice.

- Recording of issued and received invoices: Invoices must be registered in the VAT registers.

- Periodic VAT settlement: The tax must be settled periodically (usually monthly or quarterly) and paid to the State.

- Keeping the accounts: The association shall keep regular accounts, capable of documenting all transactions carried out.

- Filing of income tax return: The association shall file an annual tax return.

Which activities are exempt from VAT?

Not all activities carried out by associations are subject to VAT. The following are exempt from VAT, for example:

- Fundraising activities

- Volunteer activities

Why is it important to know this news?

The new VAT legislation for the Third Sector has a significant impact on the administrative and accounting management of associations. It is essential that the associations involved are adequately informed about the new rules to avoid sanctions and to be able to better manage their business.

Warning: Tax legislation is constantly evolving. For personalized and up-to-date advice, we recommend contacting a professional in the sector, such as an accountant or a labor consultant.

To know more:

- Third Sector Construction Site: https://www.cantiereterzosettore.it/iva-e-terzo-settore-cosa-cambia-dal-1-gennaio-2025/

- TeamSystem: https://www.teamsystem.com/magazine/terzo-settore/regime-iva/

Want to know more? Feel free to ask any other questions!

Topics you might find interesting:

- What are the differences between the flat-rate regime and the ordinary regime for associations?

- How is VAT calculated on services?

- What tax breaks are available for Third Sector associations?

I hope I have been exhaustive.

What are the responsibilities of the association president starting January 1, 2025?

Responsibilities of the President of the Association from 1 January 2025: An Evolving Framework

The introduction of the VAT requirement for many Third Sector associations starting from 1 January 2025 entails a significant expansion of the president's responsibilities.

While specific responsibilities may vary depending on the association's statutes and regional and local regulations, in general, the president of a VAT-registered association assumes the following responsibilities:

Tax and Accounting Responsibilities

- Tax representation: The president, as the legal representative of the association, is the main person responsible to the tax authorities.

- Signing of invoices: Must sign invoices issued by the association.

- Accounting Control: He has the duty to supervise the correct keeping of accounts and the regularity of accounting transactions.

- Filing of income tax return: He is responsible for filing the association's tax return.

- Payment of taxes: Must ensure that the taxes and contributions due by the association are paid regularly.

Administrative Responsibilities

- Ordinary management: The president is responsible for the ordinary management of the association, including the implementation of the resolutions of the assembly.

- Relationships with third parties: Represents the association in relations with third parties (e.g. suppliers, customers, public administration).

- Protection of social assets: It must protect the social assets of the association.

- Convening of corporate bodies: He is usually responsible for convening the assembly and the board of directors.

Responsibility towards Members

- Information: It must provide members with clear and timely information on the economic and financial situation of the association.

- Implementation of assembly decisions: It must implement the decisions taken by the shareholders' meeting.

Criminal Liability

- Corporate crimes: The president may be held criminally liable in the event of corporate crimes (e.g. false corporate communications, fraudulent bankruptcy).

- Tax crimes: In case of tax evasion or other tax violations, the president can be held criminally liable.

Attention: The responsibilities of the president may vary depending on the association's statutes and regional and local regulations. It is therefore essential that the president consults his or her statutes and, if necessary, seeks the assistance of a professional (e.g. accountant, lawyer).

What changes with the VAT number? The introduction of the VAT number accentuates the accounting and fiscal responsibilities of the president, making transparent and correct management of the association even more important.

Advice for the President:

- Training: Attend training courses on association management and tax regulations.

- Professional assistance: Rely on an accountant to manage your accounting and tax practices.

- Transparency: Ensure maximum transparency in the management of the association, informing members of decisions taken and the economic situation.

- Update: Always keep your knowledge of current legislation up to date.

In conclusion, the role of president of an association has become more complex and delicate. Good preparation and careful management are essential to avoid problems and to ensure the sustainability of the association over time.

Do you want to delve deeper into a specific aspect? Don't hesitate to ask!

I am a member of an ASD because my daughter rides horses.

I have the horse at the club where the ASD is based.

Regarding the monthly payment, does anything change in terms of VAT for me?

Good morning Renata, I'll try to answer, the monthly fee for the maintenance of the horse at the club is configured from my point of view as a payment for a fee. Therefore it could be considered a commercial activity not strictly linked to the performance of the sporting activity. Therefore the ASD should in my opinion have a VAT number and report these earnings which could then be considered VAT exempt as compensation paid by you who are a Member. However, I reserve the right to verify further.

Good morning,

I am the president of a musical band registered with the runts as an aps and with a tax code. Our income comes from an agreement with the municipality (they reimburse us for documented expenses), from the membership fees of the members and from some donations, we do not carry out any type of commercial activity towards members or other subjects. Do I have to ask for a VAT number? I also received an email from a company that proposed an in-depth webinar claiming that the membership fee is also subject to VAT, is this true?

Good morning, from what I understand the VAT number must be opened. I would advise you to contact your accountant, provided that the professional has experience in managing the accounting of associations. In the meantime I will try to contact my accountant if there has been any update with the maneuver. The membership fee as well as donations from members should be exempt from VAT. Regarding expense reimbursements, we should look into it in more detail, I can't tell you.

Thanks for the reply, reimbursements with agreement are excluded from VAT (it is the only way for a public body to give something to associations that do not have a VAT number), on the sites I have checked so far it was written that the membership fees are excluded from VAT (not exempt) so until yesterday I was calm about the fact that the VAT number was not needed, the email I received created doubts. Unfortunately I do not have an accountant and I would not know who to ask

I have no idea what will happen about expense reimbursements. I would say that logically VAT is not applied to membership fees, but from what I understand the VAT number must still be opened and the quarterly VAT declarations and the income tax return must still be done. If there are no commercial transactions, the quarterly VAT declaration will be valued at 0.

Good morning, last post then I promise not to disturb anymore, I found this link that I hope can be useful to others too

https://www.cantiereterzosettore.it/gli-approfondimenti/iva-e-terzo-settore-indicazioni-e-strumenti/

Hello, we have an ETS with PI that only carries out institutional activities, we do music training courses for kids. I was wondering if the monthly fees for music courses, for which up to now we have only issued payment receipts, are excluded from electronic invoicing or not.

A thousand thanks

Good morning, on this specific point, the accountant is the best person to ask.

If an association only collects membership fees, which should remain outside the scope of VAT, will it still be obliged to open a VAT number?

From what I understood from the accountant, as the legislation is today, yes the VAT number must be opened. Then you will have to make the quarterly VAT declarations, with zero VAT.

https://www.cantiereterzosettore.it/gli-approfondimenti/iva-e-terzo-settore-indicazioni-e-strumenti/#:~:text=Salvo%20alcune%20eccezioni%2C%20l'obbligo,5%2C%20comma%2015%20quater).

In the last few days, this article appeared in the news that claims that those who only earn membership fees will be able to continue operating only with the tax code. It all seems unclear to me, unfortunately

Hi Laura, it seems like good news and the Cantiere Terzo Settore website should be quite reliable. Thanks for sharing. I will also contact my accountant for confirmation and in the meantime I will update the post.

Hi Enrico, probable new extension.

The new VAT regime for sports and the third sector will not start in January 2025. An extension will be included in the budget, to then define a system with limits "within which we remain within the scope of exclusion". This was stated by the Deputy Minister of Economy Maurizio Leo, who spoke yesterday at the assembly of Cia-Italian Farmers. Leo immediately repeated the words pronounced by the Deputy Minister of Labor with responsibility for the third sector Maria Teresa Bellucci, who three days ago (November 27), had spoken of a postponement of the terms and of the ongoing dialogue with the Mef.

Interesting, as expected.

Membership fees also remain outside the scope of VAT, but it is the specific fees which, even if they are for institutional activities, will go from outside the scope to "exempt" pursuant to art. 10, thus obliging the association to obtain a VAT number and to comply with all the consequent obligations.

Good morning Carlo, thanks for the clarifying contribution. A question, is it "all" the fees or only those paid by "non-members"? Thanks. So assuming a case in which the association receives fees but only from members, does it still have to issue an invoice? Thanks.

Good morning, I am the secretary of a voluntary association registered with the Third Sector. I would like to point out that we already have a VAT number, regarding the new regulations that will have to come into force from 1 January 2025, as an association we are obliged to adapt or are there exemptions being examined by the government for small associations that survive on offers that are given to us by people who are accompanied to carry out medical visits.

Thank you in advance

Good morning Francesco, I too am trying to understand if there will be any exemptions, at the moment from what I understand there are none. Let's wait and see.

Is a Cultural Association that does not belong to the Third Sector obliged to open a VAT number?

A cultural association founded regularly according to the civil code and in possession of a tax code, as things stand now and from what I understand, will have to open a VAT number.

Good morning, I also have a non-profit cultural association founded regularly and with a tax code not registered with the Third Sector, so with the new legislation should I have a VAT number? However, if in the meantime I register with the Third Sector, shouldn't I be obliged to open a VAT number?

Hello, is a non-profit organization (and without a current account) that has been inactive for many years also required to open a VAT number?

Yes, that is exactly the point of the law, even non-profit organizations, if they have a tax code, must open a VAT number. However, I suggest keeping your ears open because it could also happen that the government introduces some loophole.