How is the e-commerce income statement structured and why is it important to do it right? For fashion e-commerce managers and digital directors, it is essential to know every single line of the income statement in detail.

The e-commerce P&L or income statement provides managers with a picture of the health of e-commerce, answers some essential questions, such as:

- Did we make a profit last year? Are we planning to make a profit?

- Are revenues up or down from last year (LY)?

- How much is our gross profit margin?

- How much do we spend on logistics, shipping, customer care?

- How much are we spending on marketing?

As you can see, the ecommerce P&L provides answers to some very important questions. The ecommerce P&L also answers questions about the performance of your ecommerce, such as:

- This year our gross margin decreased by 5% compared to LY

- Last year our average discount increased from 10% to 12% compared to the previous year (PY)

- Next year, shipping cost is expected to increase from 5% to 6% on net revenue

Table of Contents

Ecommerce P&L Setting Differences from Company to Company

It is important to understand that There is no single way to write an e-commerce profit and loss statement, since It depends on the financial standards we follow. Even at the accounting level there are different principles that companies can use and, depending on the standard used, the formatting of the income statement of e-channel commerce or other channel can be different.

The important thing is to maintain consistency in the way we calculate revenue and cost items in the ecommerce income statement from one year to the next, this allows us to highlight trends in performance indicators over time that are consistent with each other. For example, if we calculate the cost of goods sold one way in one year, we need to calculate it the same way the next year to be able to compare. Here are some more examples:

- This year our gross margin decreased by 5%

- This year our average discount has increased from 10% to 12%

- This year the shipping cost increased from 5% to 6% on net turnover

Ref. https://www.accountingtools.com/articles/2017/5/5/purchase-price-variance

E-commerce P&L Terms, KPIs and Acronyms

- Gross Sales or Gross Sales (Top Line): These are sales before returns and before taxes Value Added Tax (VAT) or (sales tax) or duties.

- Net Sales: Gross Sales Less E-Commerce Returns

- Earnings before interest and taxes EBIT (bottom line)

- COGS: Cost of Goods Sold

- Standard Cost: is a way of calculating the cost of goods sold based on the cost of the product components: cost of the material used + cost of the manufacturing process = cost of the product.

- Depreciation or devaluation of warehouse products: each product tends to lose value if it is not sold and remains in the warehouse for a long time. For this reason, conventions and practices are defined for the devaluation of products in the warehouse. These values are entered as costs in the income statement of the e-commerce channel.

- E-commerce Sales Tracking: Gross Sales & Net Sales

- Very often, sales in e-commerce are called with the English term Sales or Revenue to which the prefixes Gross and Net are added.

E-commerce sales tracking: gross sales vs. net sales

Very often sales in e-commerce are called with the English term Sales or Revenue to which the prefixes Gross and Net are added.

Given that the use of English does not clarify or simplify the understanding of these terms, we explain clearly what these terms mean below.

Regardless of the accounting standard we adopt, the terms net and gross sales must be very clear within the company and must reflect the needs for tracking the results of the e-commerce channel with respect to targets.

| Sales | Explanation |

| Gross sales | Gross sales VAT included or receipt. It corresponds to the total amount paid by customers for the products purchased. Sometimes this concept is associated with the concept of "Demand" or the orders of end customers entered into the system before discounting any returns or delivery problems. |

| Gross sales before discounts | It refers to the theoretical price or list price that users would have paid if they had purchased without discounts. This metric is used to calculate the average discount applied by the e-commerce or retail channel compared to the list price and therefore also compare the performance between channels, for example which channel between e-commerce and retail offers more discounts? |

| Net Net Sales | Net Net sales represent net sales returns and net VAT then Gross Sales - VAT - Returns = Net Net Sales |

| Revenue | Turnover is an accounting data which means sales in VAT and Net Credi Notes issued + Any deferrals (estimate of credit notes not yet issued but pertaining to the reference period, for example year or quarter) |

The calculation of e-commerce sales with the standard cost + mark-up method

If we calculate gross sales with the standard cost + mark up method, for example, we can accurately estimate sales gross of discounts. While if we calculate the sales on the basis of the collection we lose the information on the discount made.

The income statement of the e-commerce channel generally looks like this:

| Sales gross = standard cost or industrial cost * mark-up | |

| Industrial cost | 50 |

| Mark up | 3 |

| Selling price | 150 |

| Total units sold in the period (e.g. one month) | 1.000 |

| Gross turnover | 150.000 |

| - Discounts | 15.000 |

| Gross sales net discount | 135.000 |

| - Returns | 35.000 |

| = Net sales | 100.000 |

Returns reporting in ecommerce P&L

Returns in e-commerce can be reported in two ways: through the date of receipt of the return in stock or through the date of issue of the invoice or sales receipt.

The first way does not require an estimate of the amount of returns that will be received in the period, as the returns are recorded in the accounting system after the physical receipt of the product. While with the second method it is necessary to estimate the returns that will be received after the expiry of each tax reporting period.

Let's take an example to explain this second method of calculating returns which, in my view, is the most correct: imagine you are managing an e-commerce of physical goods, let's say fashion products, you are on December 1st and you decide to extend the return period for all orders received from 1st to 31st December to the end of January of the following year. By doing so, you are effectively influencing the e-commerce operating result by artificially reducing the returns of the current period by moving them to the first quarter of the following year.

My operational recommendation is therefore to calculate the average return rate of the site and apply the average return rate in the calculation of returns at the time of closing the balance of the e-commerce channel.

The income statement of e-commerce, a simplified model.

| Sales | |

| - Gross sales | 1.000.000 |

| - Returns | 150.000 |

| = Net sales | 850.000 |

| Costs | |

| - Cost of sales (COGS) | 250.000 |

| Gross Margin | 600.000 |

| Direct costs | |

| - Human resources | 100.000 |

| - Content production (photography, descriptions, etc.) | 50.000 |

| - Technological platform | 50.000 |

| - Marketing | 100.000 |

| - Logistics | 100.000 |

| - Payments | 20.000 |

| Operating margin (EBITDA) | 180.000 |

| - Depreciation and write-downs | 50.000 |

| Profit before taxes (EBIT) | 130.000 |

The costs of e-commerce

How to Manage Revenue and Courses in Ecommerce P&L to Make It Profitable

When you run an e-commerce website or own a business that sells online, you need to be very clear about how your e-commerce income statement is structured. Checking every single line of your e-commerce income statement is essential to ensure the profitability of your e-commerce channel.

In this article we describe the cost centers essential to take into account and that determine the profitability of your digital e-commerce. You will also find an example of e-commerce p&l that illustrates all the profit and cost items.

Cost centers

Digital Production: Product Photography and Digitization

The digital supply chain is the activity that consists in the creation of photos, videos, descriptions, translations of products.

Logistics

Logistics is usually the warehouse where the goods are stored, it can be managed directly by the brand or by a rented service, in this case it is a third-party logistics 3PL. In the logistics cost we also include inbound and outbound transportation.

Cost of technology

Ecommerce requires different technological applications which must be integrated to manage all data flows: products, stock, prices, orders, customer data.

Cost of goods sold

The cost of goods sold is the first "cost item" that you find in the e-commerce income statement, the net revenues: the cost of goods sold determines the gross margin which is a KPI essential to the profitability of fashion brands.

Legal and Administrative Costs of Ecommerce

Costs that are not specifically generated by e-commerce, such as top management, finance, administration and human resources costs, are allocated proportionally to profit centers. For example, the cost of administration is divided between the Retail, Wholesale and E-commerce departments proportionally to the revenue generated by each sales channel

Cost of personnel

Ecommerce teams are made up of a few to a hundred employees depending on the size of the company. Typically you have an ecommerce manager or director, and you have a store manager, a buyer, a visual merchandiser, a graphic designer, an operations manager to oversee logistics, customer service and operations, you may have an IT person within your ecommerce team and one or more Customer Service agents.

Digital Marketing

Digital Marketing is one of the essential investments that you need to make to sell online, investing in Digital Marketing is essential to generate traffic. While in physical stores traffic is generated by location, online you need to invest in digital marketing to create traffic. You can invest in paid traffic, such as advertising, or you can create content that organically attracts visitors, this is also called content marketing.

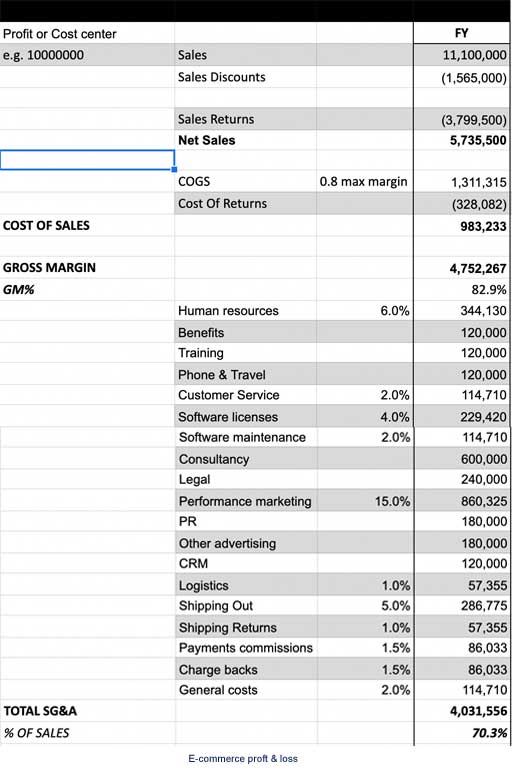

Example of ecommerce P&L

This is an example of a complete profit and loss statement for an e-commerce that sells fashion products. You can see the structure of the profit and cost centers on the left. In the first 4 rows of the income statement you have the income statement items that determine the net revenues or net sales: Gross Sales (Sales) – Discounts (Sales Discounts) – Sales Returns.

The calculation of the COGS Cost of Sales in e-commerce

From an accounting point of view, the cost of sales is any cost directly related to the product sold or we are talking about a cost that occurs only if the product is sold.

For the correct calculation of the cost of goods sold we must take into account three factors:

- Buying e-commerce: therefore the fixed assets of products that we buy and allocate on the e-commerce warehouse with the aim of selling them over the course of one or more seasons and their degree of depreciation

- COGS are costs when we sell products and are revenues when we receive returns. This is a fact, you just have to remember to calculate them correctly.

- If the availability of salable goods on the e-commerce channel is not exclusively allocated to the e-commerce warehouse but is the sum of several warehouses, the cost of sales cannot be calculated on the value of the e-commerce buying or order.

What costs should be included in the cogs in the income statement?

One possible rule is to follow who they are costs directly related to the sale of the product, therefore the raw materials used and the cost of the labor used for the realization of the product. But what do we do with the fees paid to credit cards and sales commissions? These are also expenses that only occur if a product comes, but are generally reported lower in the e-commerce income statement.

The general practice is to carry the expenses related to sales commissions further down in the income statement, because if we included all the sales expenses in the cost of sales (COGS) we would obtain a lower gross margin. If you are a publicly traded company, having a significantly lower gross margin than the competition can create valuation problems.

What goes into the cost of sales of a company that produces software as a service?

In this case the software provided to the customer is the service we sell, so we will have to enter the cost of the servers and the people who maintain the servers in the cogs, if you pay royalties on the sales of the software these are also a cost of sales and if the company helps customers use the software, this could also be considered a cost of sales.

In conclusion, the best way to determine the components of the cost of sales is to look at what the leading companies in the sector do in the reference market and ask for indications from the auditors who will be able to give sufficiently clear indications and leaving you the choice of where to place some cost elements. Once this choice has been made, it is good to keep it for different accounting periods to have the possibility of making year-over-year comparisons and determining trends.

For further information: Steve Bragg podcast episode 323 the cost of goods sold

What we have not considered

- Fixed costs and variable costs -> projection

- KPI as the average discount rate

- VAT and taxes

- Indirect costs: business costs e.g. offices, accounting, general management

Capital investments in e-commerce

Capital investments are often seen as less important than operating costs, but that's not how it works in e-commerce.

Analysts often stop at the operating cost level to determine the sustainability of the income statement of the e-commerce channel. This means that investments in infrastructure, for example the creation of the e-commerce platform, are considered below EBITDA and therefore only fall within the calculation of EBIT otherwise known as profit before tax and interest on capital.

In e-commerce, unlike physical bricks and mortar channels, investments in infrastructure are continuous because technology is constantly evolving.

| Digital channel - E-commerce | Physical channel - Bricks and mortar |

|---|---|

| Purchase or rent of an e-commerce platform | Purchase or rent shop walls |

| E-commerce platform configuration | Shop furniture |

| Implementation of additional features> Frequent | Implementation of additional features -> Rarely |

| Integration with new digital channels> Frequent | Integration with new physical channels -> No |

| Updates to the e-commerce platform> Regular frequency | Structural updates> Rarely |

Online courses for ecommerce finance

Fashion Ecommerce Management >>

Fashion Finance: Master Ecommerce Financial Planning & Cost Control >>